7 Secrets Car Dealerships Don’t Want You to Know

Not all car dealers fit the stereotype of the unethical, fast-talking salesperson determined to fleece you, but buying a car can be complicated and confusing even when dealing with the most honest and straightforward of business people. It’s best to walk into a dealership forewarned and forearmed so you can negotiate in good faith, and be able to ask the right questions. Here are 7 secrets car dealerships don’t want you to know about.

RELATED: The Best Used Cars to Buy, Experts Say.

1

Invoice Price on Car

The invoice price is what the dealer paid for the car. “You might think that you can just go to the dealership and ask for the invoice price, and then negotiate from there,” says Gauge Magazine. “The invoice price on a car can be deceiving – the dealer usually adds on a lot of extra fees and markups, which can drive the price up significantly. So, if you’re trying to get a good deal on a car, don’t focus on the invoice price – focus on what the dealer is charging.”

2

Negotiating Based on Monthly Payments

Never tell the dealer upfront how much money you want to pay monthly. “If you say your budget is $400 per month, for example, the dealer can sell you virtually any car on the lot if they string the payments out into a long enough loan,” according to GoBankingRates. “Instead, determine how much you can afford each month and multiply it by 60 (five years) to find out what you can actually afford, and then shop in that price range.”

3

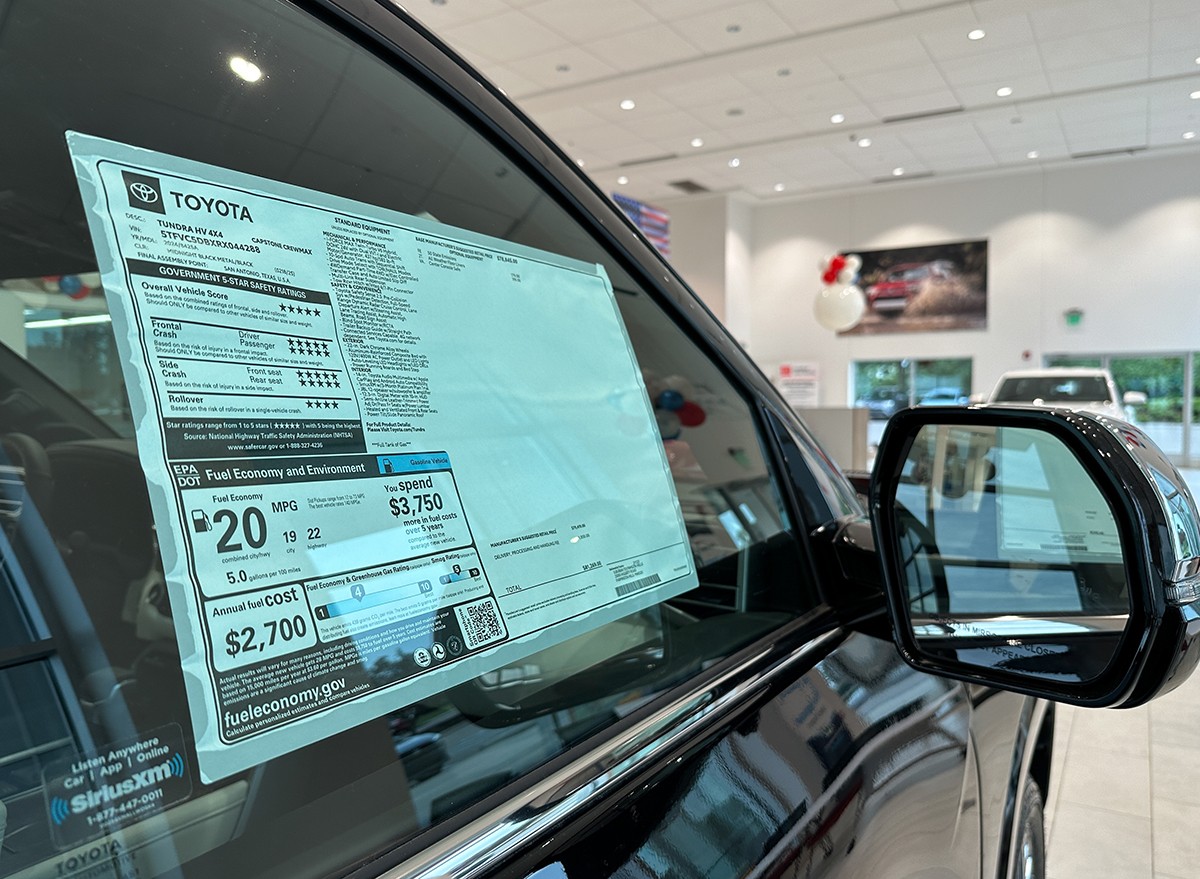

Watch Out For Add-Ons

Dealers make money through add-ons, experts warn. “Add-ons are extra features or services that the dealer adds to the car, such as a warranty or an extended service contract,” says Gauge Magazine. “Often, these add-ons can significantly increase the price of the car. Don’t let the dealer trick you into thinking that their add-ons are the only option available – there are often cheaper and better alternatives available!”

4

Refuse Extended Warranty

Don’t be tricked into agreeing to an extended warranty on a leased vehicle. “There are pros and cons to leasing — and one of the biggest pros is that you’re covered by a bumper-to-bumper warranty for the entirety of the lease,” says GoBankingRates. “By buying an extended warranty, you’re literally just giving money away.”

RELATED: 8 Worst Cars to Buy Used, Experts Say.

5

Shop at the End of the Month

Wait till the end of the month to visit a dealership. “The best time to shop for cars is at the end of the month,” says Gauge Magazine. “This is because dealerships are trying to meet their sales goals for the month, and they will often offer better deals on cars at the end of the month. So, if you’re looking for a good deal on a car, try to shop at the end of the month.”

6

Avoid Financing Through Dealership

If you finance a car through the dealership, they make money on the interest. “This is because the dealership gets to mark up the interest rate on the loan,” says Gauge Magazine. “So, if you finance a car through the dealership, you’re going to be paying a lot more for your loan than you would if you went to a bank or credit union. If you’re interested in getting a good deal on your car loan, try to get pre-approved for a loan from a bank or credit union before you go to the dealership.”

7

The Four Square Tactic

This method is notorious for giving car salespeople a bad reputation. “The way it works is that the dealer physically draws four squares on a piece of paper: one for the vehicle price, one for the trade-in value, one for the down payment and one for the monthly payments. The dealer then strategically shuffles numbers from box to box to make it appear that they’re giving the buyer a great deal, when in fact, it’s a smokescreen designed to confuse and fleece you,” says GoBankingRates. “If a dealer sits you down when you’re ready to close the deal and draws four squares on a piece of paper, walk away.”