6 Things You Should Never Keep In Your Wallet, According to Experts

Losing your wallet or having it stolen ranks high on the list of frustrating situations. However, in most cases, it’s not the end of the world—just a heavy inconvenience. You can pause your credit cards, replace your driver’s license, and lick your wounds over any lost cash. However, if you keep certain items in your wallet, things get direr, and you’re left vulnerable to all sorts of trouble. If you want to edit things down, take note. Ahead, finance and security experts tell us the worst things to keep in your wallet.

READ THIS NEXT: Always Use Cash for These 5 Purchases, Financial Experts Say.

The 6 Worst Things to Keep In Your Wallet

1. Receipts

Who among us hasn’t made a purchase only to stuff the receipt into our wallet? Well, Brandon King, founder of Home Security Heroes, says it’s a habit you should stop.

“Most people don’t know this, but your receipts are data points that can be used to get more information about your transaction, bank account information, or shopping habits,” he says. “A skilled scammer can use your receipts to call your credit card company and get more information on your account.”

If you don’t need a receipt, King suggests throwing it away securely or shredding it.

2. Blank Checks

Blank checks are necessary for a range of reasons, but finance experts recommend keeping them separate from your wallet.

“There is a lot of harm that could come from blank checks landing in the wrong hands, starting with counterfeiting checks to routing numbers and making e-withdrawals,” says Bill Ryze, a chartered financial consultant at Fiona.

If you need to access something like your routing number, simply log on to your bank’s app or website, or take a picture of your check. You’ll be able to find all the information you need without the security risk.

READ THIS NEXT: Never Use Your Credit Card for These 6 Purchases, According to Financial Experts.

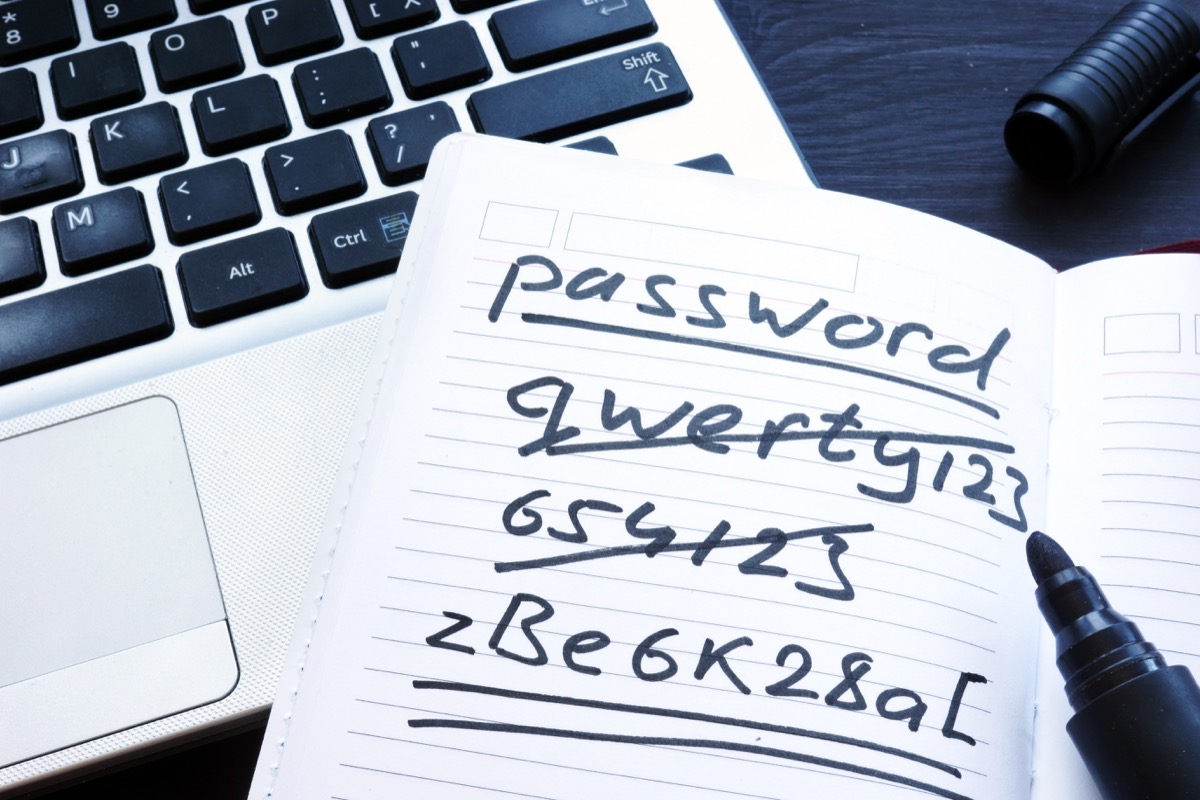

3. Passwords

This one might seem obvious, but King says a surprising number of people still carry a note with their passwords inside their wallets.

“As security advice, don’t do this—don’t even write your password on paper, period,” he says. “Keeping a list of your passwords, PINs, or an alarm code in your wallet is a huge identity risk, making it easy for a thief to steal from you.”

Instead, use a password manager. These apps offer a secure way to keep your passwords organized.

4. Keys

Sure, it’s convenient to attach your keys to your wallet via a keychain. However, it’s a huge security risk.

Because your wallet often also includes your address on your driver’s license, keeping your keys attached to it means you’re giving strangers the key to your home should your wallet go missing.

“If you lose the wallet, you must change the locks, which can be expensive,” says Wayne Bechtol, senior tax accountant at Fiona.

For more safety advice delivered straight to your inbox, sign up for our daily newsletter.

5. Credit Cards

Leaving your credit card at home is an easy way to curb spending.

“If you carry plastic in your wallet, you will use it—and chances are that you will overuse it,” says Todd Christensen, author of Everyday Money for Everyday People and education manager at MoneyFit.

“A 2014 study in Economics Incorporated suggests that the typical consumer will spend 16% more at a fast food restaurant using a credit card than cash, 42% more at a gas station cashier, 64% more at a convenience store, 78% more at a gas pump, 96% more at a grocery store, and 101% more at a full-service restaurant with tip,” he explains.

In other words, when you don’t clock exactly how much you’re spending, you’re more likely to shell out.

Carrying around a wallet that’s bulked up with plastic could also make you a target for thieves—yet another reason to edit things down.

6. Social Security Card

If there’s one thing all financial experts agree should never go into your wallet, it’s your social security card.

“Your social security card is a crucial part of your identity, and if someone steals it, you may spend months or years fighting to prove who you really are,” says Melanie Musson, a financial expert with Clearsurance.

Once someone has your social security number, they can get up to all sorts of mischief, including opening credit cards in your name and destroying your credit.

Another reason to leave your social security card at home is that you simply don’t need it.

“You likely have your social security number memorized, so you don’t need the physical card to remember your number,” says Musson. Keep it in a safe at home or a safe deposit box at your local bank or post office.