Major Banks Won’t Stop Shutting Down Branches—Here’s Why

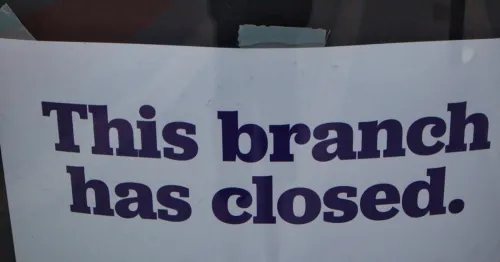

Retail closures have been taking place across nearly every industry since the start of the pandemic. And while many of these recent closures have been minor, like Walmart shuttering a handful of locations, companies like Bed Bath & Beyond and Christmas Tree Shops have gone out of business completely, taking all of their storefronts with them. Now, major banks across the U.S. are taking an aggressive approach to closures, with dozens of branches closing their doors for good. Is the industry in trouble, or is there another reason these brick-and-mortar locations are disappearing? Read on to find out why experts say banks won’t stop shutting down branches any time soon.

RELATED: 6 Banks, Including Wells Fargo and Bank of America, Closing Branches This Fall.

Several major banks are closing locations in 2023.

At least six different banks are shutting down branches across the U.S. this fall. This includes Wells Fargo, Bank of America, City National Bank, Chase, First Citizens Bank, and Santander. The closures are affecting several states in the country: Wells Fargo is closing locations in Virginia and New Mexico, while Bank of America is abandoning 12 locations in California.

This trend has been going on for years now. In 2021, CNBC reported that banks had closed a record number of branches that year, with Wells Fargo’s 267 closures leading the pack.

RELATED: Wells Fargo Is Closing Even More Branches, Starting Oct. 4.

Bank locations have actually been dwindling for almost 15 years.

According to American Banker, the last time physical bank locations actually increased in the U.S. was back in 2009. At that time, there were nearly 100,000 branches open throughout the nation. Now, S&P Global Market Intelligence data indicates that there are fewer than 80,000, per American Banker.

The pandemic only accelerated the decline of physical locations. S&P Global reported that U.S. banks shuttered a net of 2,927 branches in 2021—a record number of closures in one year. That was also a 38 percent increase in closures from 2020, which had set the previous record.

RELATED: PNC Bank Is Closing 30 More Branches in 7 States.

Experts say customer preferences have been changing.

But why have major banks continued to downsize over the years? According to American Banker, analysts believe it’s primarily the result of banks investing more in their online platforms, as customers now prefer to handle their bank transactions digitally.

“The long-term trend of shrinking branch numbers will continue as banks embrace technology and mobile banking,” Jacob Thompson, managing director at Samco Capital Markets, told the outlet.

Amy Amirault, Wells Fargo’s assistant vice president of consumer communications, also confirmed this shift toward “digital channels” in a prior statement to Best Life. “As customer preferences and transaction patterns change, so will our branches,” she said.

Santander Bank provided similar reasoning as well.

“Like many industries, our customers’ preferences have changed, with more customers choosing to bank with us online,” Santander said in a previous statement to Best Life. “Therefore, we are reimagining the customer and employee experience by simplifying our processes, refining our branch footprint, and increasing our investment in digital capabilities to align with the evolving needs of our customers.”

But people are still concerned about the decrease in branches.

Despite the shift to digital banking, not all customers are comfortable with the mass closures taking place. In fact, a new survey conducted by research agency Opinium on behalf the Daily Mail found that 51 percent of people in the U.S. say they are either “very concerned” or “somewhat concerned” about the potential impact of declining branches.

“Despite the majority of Americans preferring digital payment methods over cash, recent bank closures across the United States are still causing concern,” Grace Miller, research manager at Opinium, told the Daily Mail. “Notably, the digital transition showcases disparities in accessibility, especially for Americans with lower household incomes.”

RELATED: For more up-to-date information, sign up for our daily newsletter.