The 20 Most Affordable U.S. Cities for Retirees, New Research Shows

Retirement is the perfect opportunity to travel, spend more time with family, or start a hobby that you’ve been putting off for years. But for many, figuring out a place to live that suits your lifestyle but doesn’t deplete your savings is also a key part of this next chapter. That’s why the team at Empower recently released their list of the 20 most affordable U.S. cities for retirees.

To find the most affordable cities, Empower surveyed “200 U.S. retirees to gather their perspectives on the best cities to live in and what qualities make those cities the most appealing.” They also looked at data on tax friendliness, healthcare access and quality, home prices, cost of living, and average yearly sunshine. Keep reading to see which cities are the best for your wallet.

RELATED: The 50 Best and Worst States to Retire In, New Data Shows.

20

Virginia Beach, Virginia

Virginia Beach, the first of two cities from Virginia to make the top 20, is not only affordable, but it’s also a desirable retirement spot. When asked where they hoped to live, 12 percent of those surveyed picked Virginia Beach as their dream destination.

“The coastal Virginia town was No. 14 for healthcare access and quality (weighted at 25 percent, based on state ranking of healthcare quality and access), with a bustling senior scene, and many 55+ retirement communities,” according to the report from Empower.

19

Orlando, Florida

As the first of six cities from Florida to make the top 20, Orlando is an ideal destination for retirees thanks to its climate. According to Current Results, Orlando has an average of 236 sunny days each year.

For the Empower survey, this variable was weighted at 10 percent, and 33 percent of retirees surveyed said the weather was their top priority when figuring out where to live.

18

Tampa, Florida

Tampa, Florida has an average of 244 sunny days per year. But it’s a great place to retire for more than nice weather: It also ranked 27th on Zumper’s national rent report, with one-bedroom apartments costing around $1,600 a month.

Empower weighted home affordability at 20 percent based on median rent prices and median home prices.

17

Richmond, Virgina

Richmond, Virginia takes the 17th spot because it has a moderate cost of living. This variable was weighted at 15 percent in the survey, based on the relative index of the cost of living.

According to AdvisorSmith, any city with a cost of living index under 100 is below the national average; Richmond’s is 99.2.

16

Memphis, Tennessee

With a variety of cultural hotspots and fun recreational activities, Memphis is perfect for retirees. But the larger pull is its tax friendliness (weighted at 30 percent based on retirees’ tax laws).

Tennessee does not have an income tax, so all forms of retirement income, including Social Security, are untaxed at the state level, according to Smart Asset. Property taxes are also low, so new retirees can live comfortably here.

RELATED: The Safest City in Every State, New Data Shows.

15

Colorado Springs, Colorado

If you’re not looking for somewhere super warm, Colorado Springs fits the bill. While the city does get over 200 sunny days per year, average temperatures are more in the 60- to 70-degree range.

In addition, Colorado was ranked 13 in overall healthcare, according to U.S. News & World Report, which is part of why the city is one of the most affordable.

14

Port St. Lucie, Florida

Port St. Lucie, Florida has a higher cost of living than some of the other cities (its average is 101.1), but its warm climate and tax friendliness are what appeal to retirees.

“Florida has no income tax, which means all forms of retirement income (including Social Security) are tax-free at the state level,” according to Smart Asset. The state also has low property and sales tax.

13

Jacksonville, Florida

In addition to being affordable, Jacksonville, Florida is another city where retirees would most like to live, as 10 percent of people surveyed picked Jacksonville as their desired locale. And with the tax friendliness of the state, warm weather, and below-average living cost of 99, it’s easy to see why.

12

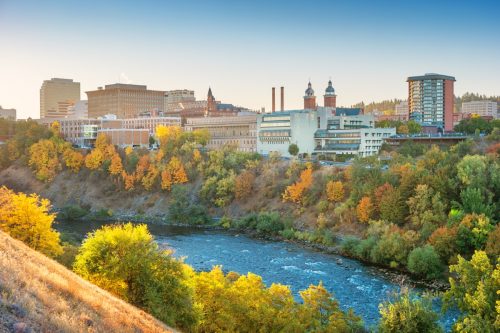

Spokane, Washington

You can rent a one-bedroom apartment in Spokane, Washington for $1,100 a month, which is much cheaper than many other cities. In addition to its home affordability rates, the city has a favorable cost of living.

And while Washington is known for its precipitation, Spokane still gets over 170 days of sunshine per year.

11

Augusta, Georgia

Augusta, Georgia is perfect for retirees who are looking for affordability. According to AdvisorSmith, Augusta’s cost of living index is 91.2. And you can rent a one-bedroom apartment for only $860 a month.

If the financial incentives aren’t enough, consider that Augusta also has over 200 days of sun per year, so there’s plenty of time to be outside.

RELATED: The 10 Best Lesser-Known Cities to Retire In.

10

Columbus, Georgia

Like Augusta, Columbus, Georgia has over 200 days of sun per year. Columbus is even more affordable, though, thanks to its cost of living index of 88.5.

Similar to other states on the list, Georgia does not tax Social Security, and sales and property tax rates are moderate, according to Smart Asset.

9

Grand Rapids, Michigan

Grand Rapids, Michigan takes the ninth spot on the list, thanks in part to the state’s quality healthcare. According to U.S. News, Michigan is ranked 20th in overall healthcare, and just 7.1 percent of the population is without health insurance.

As a bonus, Grand Rapid’s cost of living index is 93.7, putting it below the national average.

8

Gainesville, Florida

Gainesville, Florida is a lively city with a big retirement community. While its cost of living index of 97.3 is higher than other cities on this list, it’s still below average.

According to Empower, cost of living was the top priority for retirees when deciding where to live, as 46 percent of people surveyed selected that option.

7

Reno, Nevada

Reno, Nevada is ideal for retirement, especially when it comes to climate. Reno has a whopping 251 days of sunshine per year. This city also has reasonable rent, with one-bedroom apartments available for $1,300 a month.

6

Tallahassee, Florida

The last city from the Sunshine State to make the top 20 is none other than Tallahassee. You can rent a one-bedroom apartment here for under $1,000, and the cost of living index is 96.4.

Empower notes that 28 percent of people said their top priority was home prices.

RELATED: 9 Things You Should Stop Buying If You Want to Retire Early, Financial Experts Say.

5

Philadelphia

Philadelphia is the first of two cities in Pennsylvania to make the top five. While the cost of living is higher at 103.4, the state’s tax friendliness is what puts Philly higher on the list.

“Pennsylvania fully exempts all income from Social Security, as well as payments from retirement accounts, like 401(k)s and IRAs,” explains Smart Asset. They add that property taxes are a little higher than average, but sales tax is among the 20 lowest in the country.

4

Detroit

Michigan is a retirement-friendly state, with two cities in the top 10. Detroit has a surprisingly high number of sunny days per year at 180, but the real win is the state’s taxes.

According to Smart Asset, “Michigan does not tax Social Security retirement income and provides a relatively large deduction on all other types of retirement income.”

3

Sioux Falls, South Dakota

The third most affordable city for retirees is Sioux Falls, South Dakota. “Sioux Falls ranked middle-of-the-pack for most categories, has no state income tax, relatively low property taxes, and no estate or inheritance tax,” says Empower.

The city also has great air quality and tons of natural attractions.

2

Pittsburgh

Pittsburgh took second place mainly due to its healthcare. According to Empower, it ranked fifth for healthcare access and quality.

“Home of the University of Pittsburgh Medical Center, West Penn Allegheny Health System, Allegheny Health Network, and two major VA hospitals, retirees will live close to top doctors for general care and specialized health concerns,” notes Empower.

1

Las Vegas

Las Vegas takes the top spot as the most affordable city for retirees.

“For those looking for their daily dose of Vitamin D, Sin City ranked second for average yearly sunshine (292 days per year), and proved very tax-friendly, with no state income tax, and no estate or inheritance taxes,” says Empower.

Las Vegas also has a ton of retirement communities and endless entertainment options.

For more city guides sent directly to your inbox, sign up for our daily newsletter.