You Need to Earn Six Figures to Afford a Home in These 22 States, New Data Shows

In terms of financial goals, homeownership remains one that many strive for. But thanks to the state of the market, the idea of being able to afford that dream home can feel pretty hopeless compared to even just a few years ago. In fact, new data shows that you’d need to be earning at least six figures per year to be able to afford a home in nearly half of all states.

RELATED: 15 Cities Where Earning Over $100,000 Still Means You’re “Lower Middle Class.”

The latest analysis comes from personal finance website Bankrate.com, which assessed the median home sale price for January 2020 and January 2024 for all 50 states. They then used these prices to calculate monthly mortgage payments to determine affordability, assuming that homebuyers won’t spend more than 28 percent of their total income.

The results show that the national median-priced home costs $402,343, which requires an annual income of $110,871. This is a 50 percent jump over the past four years.

The research also shows that it’s becoming more difficult to find affordable housing in more places. In 2024, there are 22 states where a six-figure salary is needed to afford a new home, showing a dramatic increase from the six states where it was needed in 2020.

“Affordability is the biggest issue—finding a home that’s in your budget,” says Jeff Ostrowski, a housing market analyst with Bankrate. “The higher the price of a home, the harder it is to come up with the down payment or to qualify for the monthly payment. Home values are near record highs, and if you want a house, you have little choice but to pay a high price.”

The data also highlights how changes in the market have shifted the playing field, making it harder for first-time buyers to enter.

“Over the past few years, the supply of homes has been constrained by a number of factors, including muted homebuilding and the lock-in effect,” Ostrowski explains. “But demand for homes has been growing, and there are more buyers than sellers.”

So, which places are becoming the least accessible to buy into? Read on for the states where you need to earn six figures to afford a home, according to data from Bankrate.com.

22

Texas

Income needed: $100,629

The Lone Star State has become a popular destination over the past few years, but it’s easy to get your foot in the door. The state has seen a more than 30 percent increase in the amount needed to purchase a home since 2020, with the median home price now sitting at $332,600.

21

Maine

Income needed: $102,557

Sata shows it now takes 64.6 percent more income to afford a home in New England’s most northerly state than it did four years ago. You can expect to pay an average of $2,393 each month for your mortgage there, too.

20

Virginia

Income needed: $106,971

The median home price in Virginia currently sits at $397,600. Compared to four years ago, you will now need 43.7 percent more income to be able to afford real estate in the Commonwealth.

RELATED: The Safest City in Every State, New Data Shows.

19

Maryland

Income needed: $108,257

The current average monthly mortgage rate in Maryland is $2,526, with a median home price of $387,800. The amount of income needed to buy in here has risen more than 40 percent in less than half a decade, according to Bankrate.

18

Arizona

Income needed: $110,271

The income needed to purchase a home in Arizona has risen considerably lately, jumping 65.3 percent since 2020. The median home price here is also relatively high, at $433,000.

17

Nevada

Income needed: $111,557

Prospective home buyers now need 56.6 percent more income to purchase a home in Nevada than they did four years ago. The median home price here is $434,400 with an average monthly mortgage payment of $2,603.

16

Florida

Income needed: $114,771

The Sunshine State remains a popular home base for those looking for a warmer climate year-round. There’s been a 57.3 percent increase in the amount of income needed to be able to buy a home there since 2020, with a median home sale price of $403,500.

RELATED: The 20 Most Affordable U.S. Cities for Retirees, New Research Shows.

15

Idaho

Income needed: $114,386

There are few states where the amount of income needed to purchase a home has increased more than it has in Idaho, where it’s spiked 65 percent over the past four years to over $114,000. Median home sale price in the state as of Jan. 2024 is also $447,100.

14

Vermont

Income needed: $114,471

The Green Mountain State requires plenty of green in the bank for anyone looking to purchase a home there. It now requires 43.7 percent more income to afford the purchase, with an average monthly mortgage payment of $2,496.

13

Connecticut

Income needed: $119,614

It requires 37.6 percent more annual income to be able to affordably purchase a home in Connecticut compared to four years ago. The median home sale price here is $377,600.

12

Oregon

Income needed: $129,129

With a median home sale price of $482,800, Oregon has become less affordable for homebuyers since 2020. Data shows it now requires 46.2 percent more income since 2020 to realistically make ends meet on a purchase here.

11

New Hampshire

Income needed: $130,329

The amount of income needed to be able to afford a home purchase in New Hampshire has increased 54.4 percent since 2020. It also has a relatively high average monthly mortgage payment of $3,041.

10

Montana

Income needed: $131,357

It’s becoming much harder to afford a home purchase in Montana. The state has seen the sharpest increase in the amount of income needed to realistically buy there, skyrocketing 77.7 percent since 2020—which is more than any other state in the U.S.

9

Rhode Island

Income needed: $132,343

The smallest state in the union still requires a big salary to buy into the market. There’s been a 50.8 percent increase in the required income to affordably purchase in Rhode Island over the past four years, and the average monthly mortgage payment is $3,088.

RELATED: The 15 Major U.S. Cities Where Rent Is Plummeting the Most.

8

Utah

Income needed: $133,886

Utah has seen a steep increase in the amount of income needed to affordably purchase a home there, jumping 70.3 percent compared to four years ago. The median home sale price also now tops half a million dollars at $525,500.

7

New York

Income needed: $148,286

Today, those looking to purchase in the Empire State will need about 32.9 percent more income compared to 2024 to do so affordably. The average monthly mortgage payment is also relatively steep at $3,460.

6

New Jersey

Income needed: $152,186

Homebuyers will need to be making 45 percent more than they were in 2020 to be able to afford a home in New Jersey now. The median home sale price here is $495,600, with an average monthly mortgage of $3,551.

5

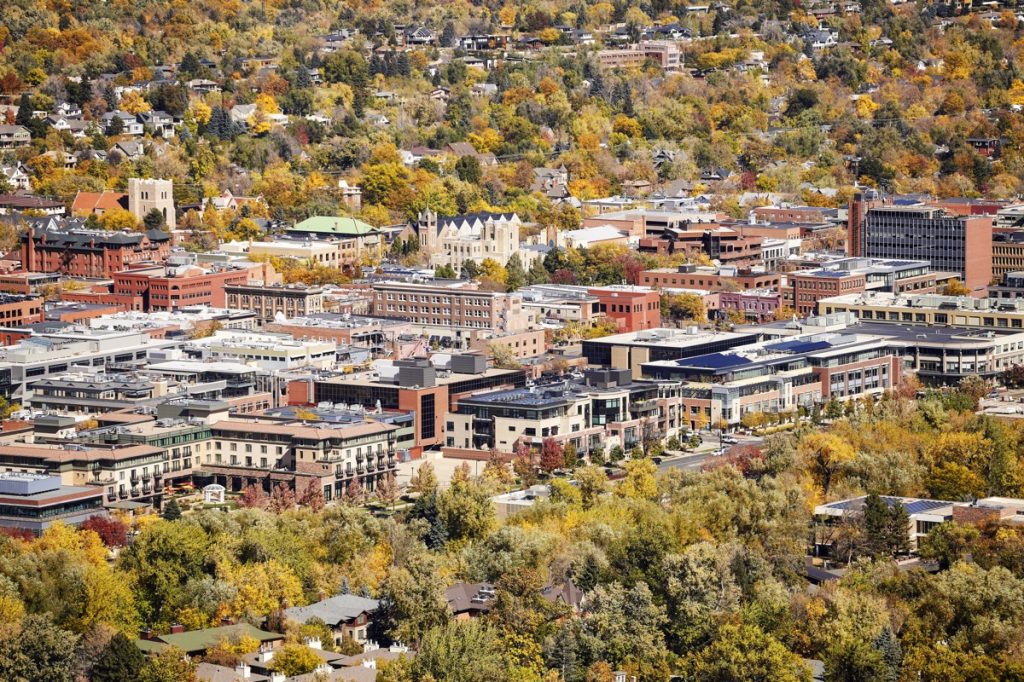

Colorado

Income needed: $152,229

Getting a home in Colorado now requires 54.5 percent more income it did four years ago, according to Bankrate. The median home sale price is also relatively steep at $591,400—the second highest of any state.

4

Washington

Income needed: $156,814

Not only has Washington seen a 52.9 percent increase in the amount of income needed to affordably purchase a home there, but it’s still relatively expensive compared to other places. At $587,200, it has the third-highest median home sale price and an average monthly mortgage of $3,659.

RELATED: 9 Essential Tips for Buying a Home When it’s the Worst Time to Buy.

3

Massachusetts

Income needed: $162,471

Home shopping in the Bay State? Data shows you’ll need 40.3 percent more income than you did in 2020 to afford one. The median home sale price is also relatively high at $572,900.

2

Hawaii

Income needed: $185,829

Moving to a state as beautiful as Hawaii won’t be easy on the finances. In addition to requiring about 46 percent more income to afford a home there, it has the second-highest average monthly mortgage payment at $4,336, as well as the second-highest median home sale price at $735,900.

1

California

Income needed: $197,057

It’s official: California tops the list of states that require the most income to afford a home, jumping 48 percent since 2020. It also is the highest in the nation for both average monthly mortgage and median home sale price at $4,598 and $739,200, respectively.