The 8 Best Cashback Credit Cards for Everyday Purchases

These could save you big bucks, finance experts say.

If you're not careful, shopping on your credit card can lead to overspending, high-interest credit card debt, and a depleted savings account. However, by making thoughtful purchases and choosing the best cashback credit card, you can not only save money but also put dollars back in your pocket.

"Many people get credit cards for store discounts, airline miles, or hotel points, but I have always preferred cashback cards," says James H. Lee, founder of StratFI. "The rules are easier to follow, and the benefits are much less restrictive."

Jason Gaughan, head of consumer credit card products at Bank of America, recommends looking into signup offers before applying for your next cashback credit card, as these often provide generous incentives for new cardholders.

"In order to make your cashback credit card worthwhile, be sure to look for additional ways to earn a cashback bonus through promotions or loyalty programs from your financial institution," he adds.

Gaughan notes that cashback cards can be an excellent savings vehicle, since you can redeem cash back as statement credits or a direct deposit into a savings or checking account. Unlike points-based or miles-based cards, there's no need for conversion rates when redeeming cash back.

"This simplicity makes cash back cards work for those looking to maximize their spending [benefits] on everyday expenses without the hassle of navigating complex rewards systems," he says.

Wondering which cashback credit cards offer the biggest rewards? These are the eight that finance experts recommend.

RELATED: 5 Credit Cards That Will Actually Save You Money on Gas, Experts Say.

1

Capital One Quicksilver

Lee says he has two cashback credit cards from Capital One—one for business purchases and one for everyday, personal purchases. These are the Capital One Spark Business Card and the Capital One Quicksilver Card, both of which offer 1.5 percent cash back on all purchases.

"My Quicksilver personal card from Capital One offers many benefits in addition to cash back," says Lee. These include free currency exchange for international travel, access to Capital One airport lounges, exclusive access to events, free credit monitoring, and more.

"Additional travel benefits include auto rental collision damage waiver, travel accident insurance, and reimbursement for lost luggage," he notes.

RELATED: Always Use Your Credit Card for These 5 Purchases, According to Financial Experts.

2

Chase Sapphire Card

Lee also recommends the Chase Sapphire, which offers not only cash back but also points on travel, dining, hotels, car rentals, and more.

"Capital One isn't the only player in the cashback reward business. I once suggested to a friend that she check into the benefits of her Chase Sapphire card after using it for over a decade, and she discovered that she accumulated $3,000 in her cash rewards account!" he tells Best Life.

3

Chase Freedom Unlimited

Scott Lieberman, founder of Touchdown Money, recommends the Chase Freedom Unlimited for earning everyday cashback.

"If you dine out regularly, this is a great card. You'll get 3 percent cash back on all restaurant and drug store purchases, plus 1.5 percent cash back on other purchases. If you travel, you can get 5 percent back on Chase Travel purchases," he says.

RELATED: 5 Red Flags About Credit Card Balance Transfers, According to Experts.

4

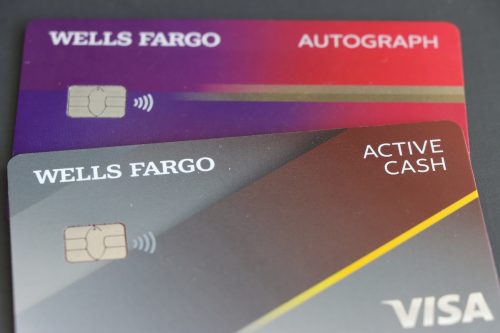

Wells Fargo Active Cash

According to Lieberman, when you're looking for a cashback credit card, you want one you can use regularly that ideally has no annual fee: "Unless you're looking for specific rewards or status, there's no reason to carry a fee for your card."

Erica Sandberg, consumer finance expert at CardRates.com says the Wells Fargo Active Cash fits the bill. "It offers a flat 2 percent cash back and no annual fee. It's an easy way to get rewards," she tells Best Life.

5

Wells Fargo Autograph

Thomas Brock, CFA, CPA, expert Contributor at Annuity.org, says he looks for hassle-free cashback credit card options that offer handsome rewards across diverse spending categories.

"Based on these criteria, the Wells Fargo Autograph is a standout. It offers 3x bonus points on dining, travel, transportation, gasoline, streaming service subscriptions, and cell phone plans and 1x bonus points on everything else. There are no spending limits on the bonuses, and there is no annual fee," he shares.

Brock adds that anyone with "a sound budget and a propensity to save" will likely benefit from this cashback card. "By using it for day-to-day purchases and recurring monthly bills, you can quickly accumulate points. Then, by simply cashing them in for statement credits, you can continuously reduce your expenses and improve your financial well-being," he explains.

RELATED: 5 Ways Your Credit Card Is Ruining Your Finances.

6

American Express Blue Cash Preferred

Sandberg says the American Express Blue Cash Preferred is a "fantastic" choice for tiered cashback rewards.

"It gives you the opportunity to earn between 1 percent and 6 percent back on everything you buy. There is no annual fee for the first year, and after that, it's $95. However, it comes with plenty of perks, including a terrific signup bonus of $250 after spending $3,000 within the first six months of opening the account," she adds.

7

Bank of America Customized Cash Rewards Card

Another highly recommended cashback card for everyday purchases is the Bank of America Customized Cash Rewards Card. This is especially beneficial for anyone who tracks their purchases and has a good handle on where most of their spending goes.

"The Bank of America Customized Cash Rewards credit card allows you to earn 3 percent cash back in one of six categories of choice that you can change each month, such as online shopping (including streaming, cable, internet and phone plans), travel, dining, gas and EV charging, home improvement and furnishings, and drug stores and pharmacies," explains Gaughan.

He notes that cardholders also earn an automatic two percent cash back at grocery stores and wholesale clubs (up to the first $2,500 in combined quarterly purchases) and one percent cash back on all other purchases.

"Whether you're booking your next trip, buying tickets online, or planning your next home renovation, the Customized Cash Rewards card is great for anyone who prioritizes flexibility and wants to maximize their rewards by tailoring their cash back categories to match their changing spending habits," he says.

8

Bank of America Unlimited Cash Rewards Card

If you're looking for a more streamlined card that offers the same benefits across the board, the Bank of America Unlimited Cash Rewards Card might be right for you.

"With unlimited 1.5 percent cash back on all purchases, you can maximize your rewards without tracking spending categories. With no limit to the amount of cash back you can earn, the Unlimited Cash Rewards card makes every purchase feel rewarding, no matter how big or small," Gaughan says.