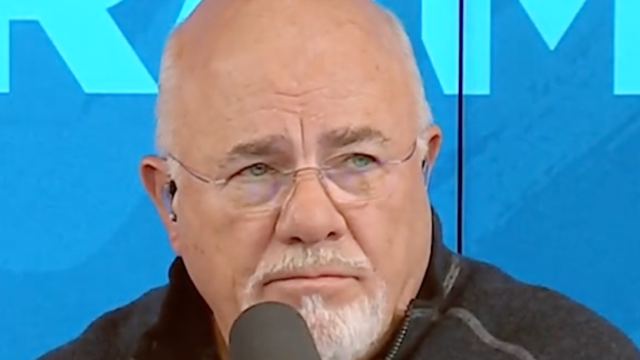

Dave Ramsey Reveals the Sure Sign You're "Going to Stay Middle Class"

The financial guru shares how your vehicle choice can derail your financial goals.

Personal finances are exceptionally unique, but for any middle-class person with goals of improving their overall financial well-being, understanding what does and doesn't make a healthy investment is key. For instance, eliminating luxury expenses, like a brand-new, high-end car, will help keep your finances intact and propel you onward in your wealth journey, according to financial expert Dave Ramsey.

RELATED: 15 Cities Where Earning Over $100,000 Still Means You're "Lower Middle Class."

A fan of eclectic motor vehicles himself, Ramsey explained in a series of TikTok videos that for most middle-class people, buying a swanky, new car isn't a financial gain. Rather, he says, it threatens one's financial wealth because cars lose their value over time, while simultaneously draining their owners' pockets.

"I guarantee you'll be broke your whole life as long as you stay in car payments because it's the most expensive thing you buy that goes down in value," he said in a video, per Benzinga.

Ramsey then double-downed on his statement, noting that one of the worst things a middle-class family can do is purchase two luxury cars back-to-back. Now they have to juggle two monthly car payments on top of other costly recurring expenses, such as a mortgage, medical bills, or tuition.

"The way you know someone's going to stay middle class is when they have two very nice cars with obvious five to seven hundred dollar payments sitting in front of a middle-class house," Ramsey said in another TikTok video.

The only way to move upwards in your financial mobility is to "break that habit," he added.

In the spirit of growing your financial wealth, Rob Whaley, a finance specialist with Horizon Finance Group, previously told Best Life that just because you get approved for a substantial car loan, doesn't necessarily mean you should run with it.

"Those luxury cars may look great, but they're a big hit on your wallet," he said. "They lose value fast, and you're better off with reliable wheels that won't break the bank."

However, if you have your eyes set on a premium elite car, Ramsey advised in his videos that the best thing you can do is buy it used, Benzinga explained. Although some cars, such as a Jeep Wrangler or Honda Civic, are known for retaining their value, Ramsey argued that those vehicles are the exception, as most lose 60 to 70 percent of their value before they're even five years old.

On a similar note, Jonathan Merry, a personal finance expert with Moneyzine, had told Best Life that one of the best money moves a middle-class person can make when shopping for a vehicle upgrade is to purchase a pre-owned, high-quality car that's around three years old.

"At that age, the first owner has dealt with the biggest price drop or depreciation bulk, saving you money," he explained.

Best Life offers the most up-to-date financial information from top experts and the latest news and research, but our content is not meant to be a substitute for professional guidance. When it comes to the money you're spending, saving, or investing, always consult your financial advisor directly.