3 Major Changes Coming to Social Security in 2024 and How They’ll Affect You

You typically want your finances to remain as steady as possible, but Social Security isn’t exactly staying the course. According to The Motley Fool, the social insurance program will undergo a number of changes next year. Some of the planned updates are positive, and suggest that inflation may be slowing down. Others, however, may prove more frustrating, especially if you’re still a ways off from retirement. Read on to discover three major changes coming to Social Security in 2024, and how they’ll affect you.

RELATED: 5 Secrets About Your Social Security Benefits, According to Financial Experts.

1

There’s a higher earnings cap.

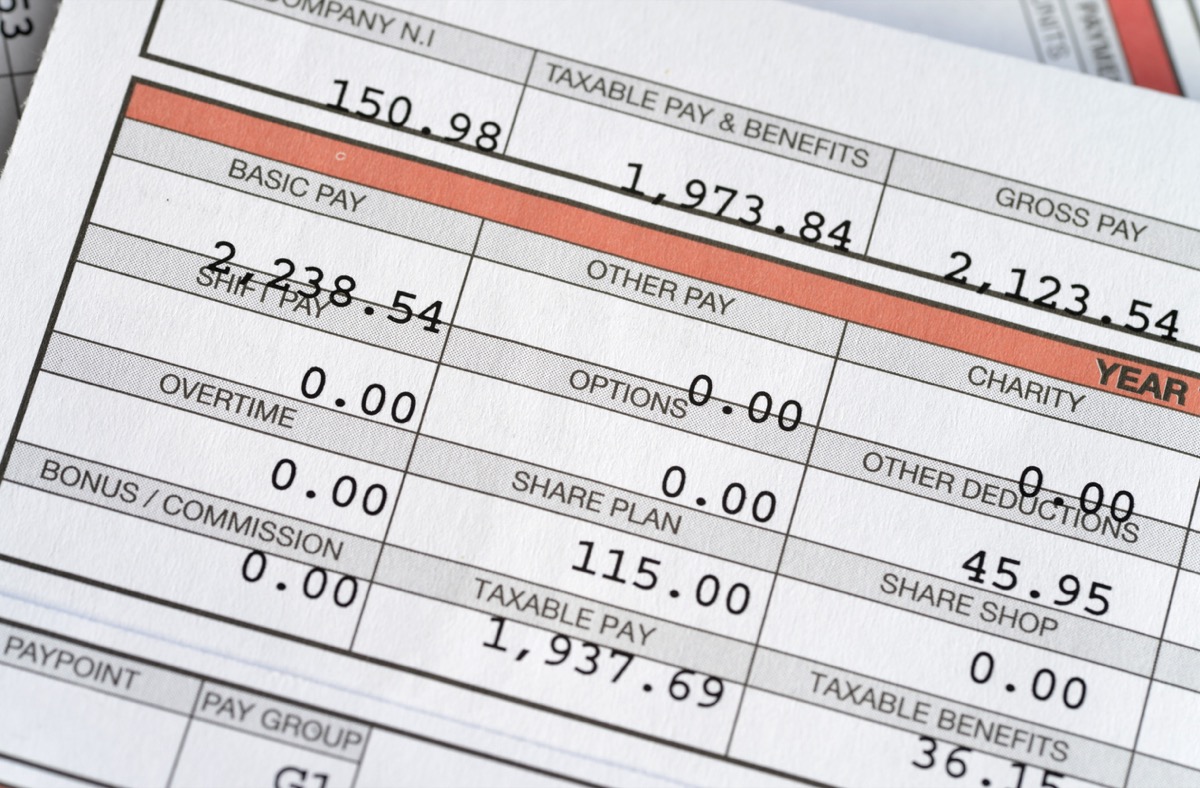

The U.S. government funds Social Security by taxing earned income. According to figures from the Social Security Administration, workers for legitimate companies pay 6.2 percent of their earned wages in Social Security taxes, while employers pay the other 6.2 percent. (Self-employed workers pay 12.4 percent.)

Those taxes are only applicable up to a certain salary cap, which is determined each year. In 2022, that cap was set at $147,000. In 2023, it increased to $160,200. But in 2024, it’ll jump even more to $168,600. In other words, if you’re making more than $160,200, expect your Social Security taxes to go up a little bit next year.

Any income over $168,600 will not be hit by the Social Security tax.

RELATED: IRS Has Announced All These Changes to Your Taxes—Will You Be Affected?

You can’t collect Social Security until you retire.

You can’t collect Social Security checks until you formally retire, and the levels of payment you can receive depend on when you choose to retire.

You can technically retire and start collecting Social Security payments at 62, but your payments will be approximately 30 percent lower than they would be if you wait until your “full retirement age,” according to the Social Security Administration.

If you were born between 1943 and 1954, your full retirement age is 66. If you were born after 1960, you’ll need to wait until you’re 67. Lastly, if you choose to wait until you’re 70 to collect benefits—regardless of birth year—your payments will be 8 percent higher than they would be if you started collecting at 67.

But there’s a catch when it comes to next year’s changes…

RELATED: 10 Things You Should Stop Buying When You Retire, Finance Experts Say.

2

Work credits will have a higher income threshold.

To earn Social Security payments in the first place, you need to accrue 40 work credits over the course of your career at a max of four per year, according to The Motley Fool. Here’s how that worked in 2023: Every $1,640 of wages you earn each year corresponds to one credit. In 2024, however, you’ll need to earn $1,730 per credit.

For full-time workers—either on a salary or wage basis—hitting the annual work limit in 2024 shouldn’t pose a problem. But part-time employees and gig workers may have a tougher time reaching the threshold. It might be worth doing some math to see where you fall in the mix.

3

Social Security benefits will increase.

Now for some good news: If you’re collecting a Social Security check, it’ll be a little bit bigger next year.

Since the early ’70s, Social Security payments have increased in accordance with cost-of-living adjustments (or COLAs). The general thinking is that inflation all but guarantees that everything you pay for—from clothing and groceries to gas and housing costs—will get a little bit more expensive each year. COLAs ensure Social Security payments keep pace with those additional costs.

Next year, payments will increase by 3.2 percent due to COLAs. While not as high as the staggering 8.7 percent of 2023, The Motley Fool notes that it’s a sign that the inflation crisis of the past few years is finally easing a little bit.

However, we’re still not quite back to average: The Federal Reserve targets an annual rate of inflation of 2 percent. When we reach that point, we’ll be considered “normal.”

RELATED: For more up-to-date information, sign up for our daily newsletter.

Best Life offers the most up-to-date financial information from top experts and the latest news and research, but our content is not meant to be a substitute for professional guidance. When it comes to the money you’re spending, saving, or investing, always consult your financial advisor directly.