50 Things No One Over 50 Should Waste Their Money On

C'mon. By now, you should know better.

With age comes wisdom—usually. After a lifetime of spending, the lens on what's worth buying and what's not focuses into a crystal clear scope of 20/20 vision. (Direct flights, name-brand snacks, and sheets with high thread counts: totally worth it. The budget-quality alternatives: well…)

And yet, not every purchasing decision is so cut-and-dried. Even into middle age, it's possible to keep wasting money, thanks to the surreptitious sales practices of retailers (and, in many cases, your own laziness). Sure, it's just a few bucks here or there, but all that adds up—fast. So, without further ado, here are 50 such things you'd be wise to not spend another penny on.

1

Simple Home Repairs

By the time you're 50, you should know how to change a busted doorknob or caulk a damaged threshold. There's no need to dish out extra dough on a handyman to do it for you. Still, with that in mind, don't get too confident about your DIY skills. Know when a project is beyond your skill level. Otherwise, you run the risk of causing injury, or worse: Permanent damage to your home.

2

Fancy Coffee

Let's do some math. An two-shot espresso beverage at your nearby Starbucks runs about four bucks. Do that twice a day, Monday to Friday, and you're dropping $40 a week on coffee. At that rate, you could have enough cash saved up for a full-blown, industry-grade espresso machine of your own in a month or two.

3

The Latest Phone Model

Face it: The iPhone X is not that much better than the iPhone 8. And yet, it retails for nearly twice the price ($999 to $599 respectively). Plus, if you really want an iPhone X that bad, just look at Apple's own pricing history and you'll know that, in no time, it'll be on the market for a fraction of the cost it is today.

4

Phantom Electricity

There's a good bet you're constantly draining electricity without even realizing it. For proof, look at the power bills of our country. Everything from sleeping laptops to over-charged phones (that's when a phone is at 100 percent battery life and is still plugged in) is estimated to cost U.S. consumers about $19 billion a year. Thankfully, cutting back is simple: just turn off or unplug devices you aren't using.

5

Designer Supplements

That intriguing new vitamin may have seemed like the cure to all that ails you when you saw it in an Instagram ad at 1:00 a.m., but make no mistake: you're paying an arm and a leg for little more than your usual supplement's ingredients in a fancier wrapper. The advertising, packaging, and celebrity spokespeople who promote those amazing-looking supplements all cost money, meaning the price is going to be significantly higher than your run-of-the-mill drugstore multivitamin. For supplements you should actually splurge on, consider The 50 Best Supplements on the Planet.

6

High-End Olive Oil

If you cook a lot, you probably burn through vats of olive oil on the regular. But, unless you're a connoisseur or a chef with a rep to uphold, there's no need to splurge for the expensive, grade-A, straight-from-Italy stuff. For run-of-the-mill meals, your good ole bottle of Filippo Berio will do just fine. Only the truest of champagne palettes will pick up on this beer-budget difference.

7

Headphones

Like the latest smartphone, manufacturers are finding ways to make headphones increasingly more expensive and unnecessarily complicated. From $180 Apple Ear Pods to $300-plus Beats by Dre headphones, you should know better than to blow big money on a product that only gives you a marginally better listening experience than a $10 set of earbuds you can pick up from your corner store. Plus, you know you'll lose them anyway.

8

Purebred Pets

Unless you're dead set on entering your pet in Westminster, it's silly to invest thousands of dollars in a dog from a breeder. You could just as easily find an equally beautiful—and deserving—pup at a local shelter or ASPCA outpost. Those animals need homes, too.

9

Modem Rental

When you first sign up for internet service, the provider kindly provides you with a modem—and then proceeds to charge you monthly for the convenience. Often, the fee can run up to $10 extra per month. Consider the fact that you can pick up a modem for under $100 these days, and simple math will tell you that, within a year, you've already spent more than necessary.

10

Dry Cleaning

A pair of pants and shirt can end up costing you $10—and a lot more than that in urban environments. Make this a habit, and you'll see your expenses quickly pile up—all for no reason, since most garments can be cleaned easily by washing on the delicate cycle or being hand-washed at home. The sole exceptions: suits, gowns, cashmere (and anything else marked "dry clean only").

11

Paper Towels

While using paper towels here and there is necessary for most people, chances are you can cut down on at least three-quarters of your paper towel use by stocking a few shop towels for cleaning up spills, wiping down your kitchen counter, and other basic uses like that. Instead of grabbing up a handful of pricey paper towels every time something needs to be cleaned up use and reuse these actual towels and toss in the laundry.

12

Simple Car Repairs

Sure, you may be less likely to know how to repair a car engine than your father or his father. Still, that's no excuse to pay for the high costs of a mechanic when there are millions of tutorials out there (start on YouTube) that'll teach you how to effortlessly change a tire or car battery. Save your money for the repairs that actually require a professional touch.

13

Lottery Tickets

1 in 292,201,338. Those are your chances of winning Powerball. And other national lottos don't boast much better odds. Entering once in every Powerball—which happens twice a week—means you're practically setting fire to more than $200. That's money better spent on, well, anything.

14

Premium Gas

While you may want to baby your car as much as possible, if you're shelling out for premium gas, you're doing little more than emptying your wallet twice as fast as you would if you opted for regular. Unless your car specifically requires premium gasoline, it should run just fine without it, potentially saving you a significant amount of money every time you hit the pump.

15

ATM Fees

Sure, you tell yourself, sometimes my bank just doesn't have an ATM nearby. Gotta eat that extra charge! But on this, you're wrong. These days, if you venture out of the vice-grip of America's behemoth banks, you can find plenty of offerings that'll ensure you never pay an ATM fee again. An online bank like Ally, for instance, reimburses your fees at the end of every statement cycle (though they levy a 1 percent surcharge on international ATMs).

16

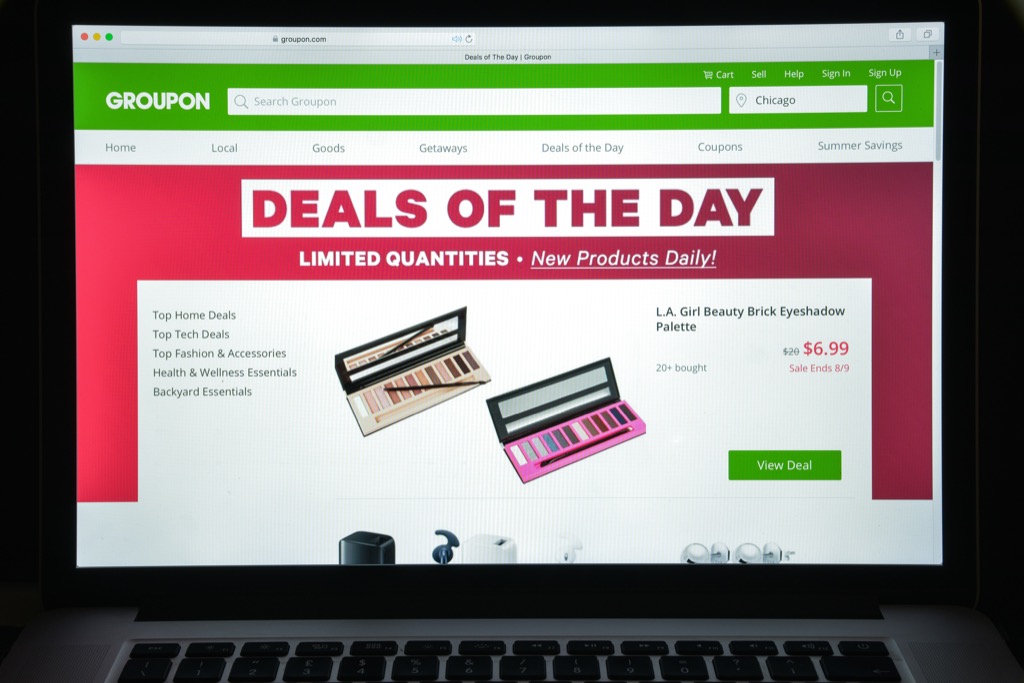

Dumb Groupons

It's amazing how much money a person can waste while thinking they are saving money. One of the clearest examples of this: "groupons" and other "deals" on subpar restaurants, outings, and all manner of stuff you otherwise wouldn't buy (and certainly don't need). But let's put it this way: paying $30 at a restaurant for $60 of low quality food is still $30 you could have better spent elsewhere.

17

Full-Priced Clothing

Sure, buying nice brand-name clothes can be one of life's luxuries and may be worthwhile compared to trying to save by buying low-quality clothes that won't last as long. But you should know better than to splurge on clothes when they've just been released in the store and still selling at full price. Retailers constantly put their wares on sale. Just bide your time (generally no more than three months) and you'll be rewarded with end-of-season markdowns.

18

Late Fees

With auto pay and similar services you have little excuse these days for failing to pay your credit card bills on time, incurring the sizable fines those companies like to hit you with.

19

Credit Card Interest

You also should be spending within your means enough that you aren't getting whacked with interest fees for only paying the minimum fee. If you are finding that you regularly are only able to pay off a small part of your cards each month, it may be time for you to do a serious assessment of your spending.

20

Extended Warranties

Spending the money on a warranty for a major purchase might at first seem like a very responsible idea—after all, if something goes wrong with the appliance you just bought, wouldn't you feel smart for having just spent a small amount of money up front allowing you to save on having to buy a whole new one? But, in fact, the chances you will actually use that warranty are slight and most warranties don't even cover the majority of problems you'd be likely to encounter.

21

Rental Car Insurance

Rental car companies love to convince you that you're a fender bender away from bankruptcy and your only protection is to buy their overpriced insurance. Like extended warranties, it's highly unlikely you will actually ever need to use this insurance and even if you did, these sneaky policies would be unlikely to cover. Often your credit card company provides stronger protections and has more incentive to cover your costs, allowing you to decline the rental company's offer. And if you're hitting the road in a loaner any time soon, be sure to steer clear of The 20 Worst Rental Cars of the Last 20 Years—Ranked.

22

New Car

This is maybe one of the biggest money burners out there, with a new car estimated to lose about 11 percent of its value the moment you drive it off the lot, leaving you with a sizable monthly payment for years to come. A wiser move is to get a used car in good condition—and paying it off as fast as possible.

23

Parking Tickets

Nobody intentionally gets parking tickets, but if you are fairly responsible and aware of your surroundings, you should be able to avoid getting hit with them. Whether that means setting your alarm to make sure you wake up in time to move the car or taking an extra spin around the block to find a spot where you can park for more than a one-hour window, you should know that it's worthwhile to put in the extra effort to avoid the $45 ticket.

24

Bottled Water

Staying hydrated is a good thing, but bottled water is not the answer. Not only does the price of it add up (especially if you're splurging on Voss, like Dwayne "the Rock" Johnson), but it's bad for the environment, too. Every disposable bottle adds to our planet's long-running trash problem. Get yourself a stylish, refillable bottle and keep it in your bag, saving yourself a few bucks a day and helping out Mother Nature at the same time.

25

Eating Out

A nice meal at a fancy restaurant can be one of life's great pleasures and a good way to celebrate a special occasion or just the fact that it's the weekend. But when you make a habit of hitting up restaurants, spending money on the meal, drinks, and a good tip two to three nights a week, your credit card bill is going to start looking pretty ugly.

26

Buying Lunch

Another easy way to waste hundreds of dollars a month is by buying your lunch at the office each day. Have enough foresight to make your lunch the night before or prepare a big batch of something delicious that you can use for your lunch over the week. Then you can spend your lunch break going for a walk, meeting a friend for coffee, or some other more enriching activity than picking up your daily desk salad.

27

3-D Movies

Movies are already ridiculously expensive (especially when you throw in the service charge for online ordering), so why would you want to add another $5-to-$10 per ticket so you can be forced to wear glasses while you watch the movie. Once you've seen one 3-D movie, you realize that it adds virtually nothing to the entertainment value or experience and, if anything, is a distraction. Save the money for something better.

28

Pricey Gym Memberships

Instead of paying a hundred bucks or more a month to use an elliptical machine a couple times a week, get into the habit of going for a jog around the neighborhood. If that's not possible or the weather conditions make such a plan too unpleasant, then at least call your gym and ask them to bring down the price—or go elsewhere for a better deal.

29

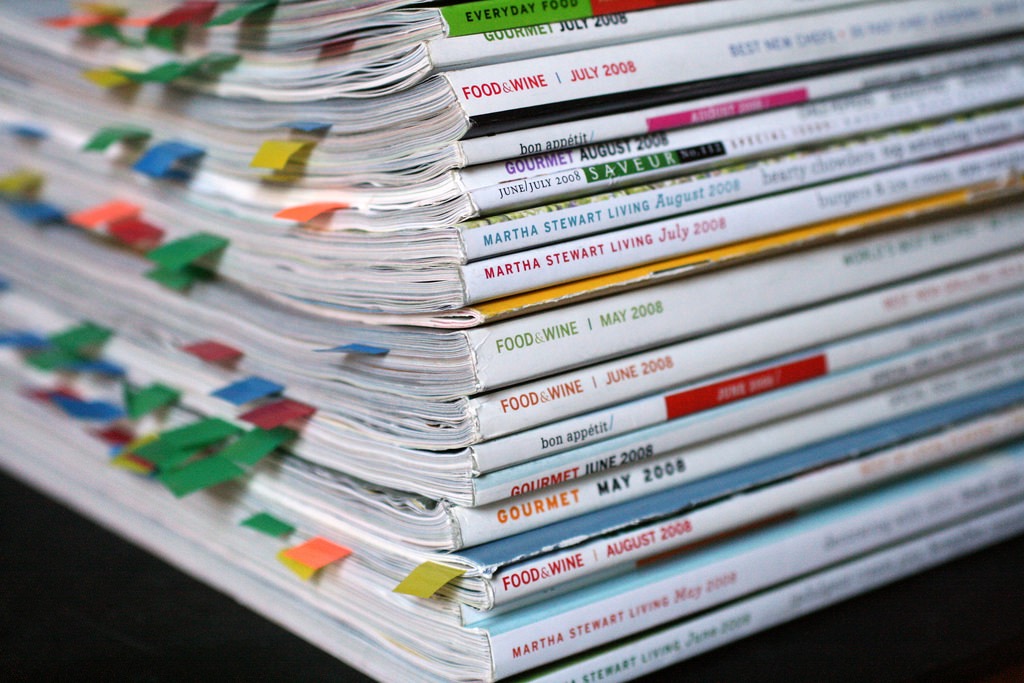

Unused Subscriptions

Whether it's magazines, SaaS services, or video streaming memberships, you should have learned by now to cut out subscriptions that you don't really use. You should set calendar reminders so you know when automatic renewals are coming and cancel as soon as you know that you will not really be needing these subscriptions or services again, or at least for a while.

30

Fancy Cleaning Products

While a stroll down the home supply aisle of the grocery store will make you think you need a special cleaning product for every different surface in your home, the fact is that basic soap or bleach and water is usually all you need to get your place looking spotless. And skip the pricey Swiffer wipes and other products that do what a damp rag can accomplish at a fraction of the price.

31

Pre-Sliced Food

While pre-sliced cheeses and meats might make it easier to whip up a sandwich, it also often costs as much as twice the same stuff will cost you when you have to do the cutting yourself. You should know better by now that this is a waste of money and taking the two seconds to do your own slicing is well worth it.

32

Extra Phone Chargers and Power Cords

Whether replacing phone chargers you forgot while traveling or having to pick up a new power cord for a laptop to cover for the one you forgot at home, you should have learned to keep track of these products and save yourself from having to pay the often exorbitant fees charged by airport shops and drug stores to replace them.

33

Grocery Shopping…While Hungry

Since you've been old enough to buy your own grocery, you've been told not to go grocery shopping hungry, and that wisdom remains as true as ever. You've likely made the mistake a few times and ended up with a refrigerator full of food you don't actually need that you would not have bought had you not been starving. And for more ways to cut down on your Whole Foods bill, check out 15 Grocery Shopping Mistakes That Are Killing Your Wallet.

34

Fancy Laundry Products

Speaking of laundry, another thing you should know by now is a waste of money is all the fancy laundry products that television commercials convince you will improve your clothing and make it cleaner and more comfortable. Fabric softener and pricey detergent makes only the slightest impact on your clothing (if any). If you opt for just basic, generic-brand detergent, it's frankly unlikely you will be able to notice any difference.

35

Ordering Delivery

There are some nights where you just don't have the time or energy to whip up a meal and takeout is the only logical choice. While that's fine now and then, you can save yourself a few bucks by avoiding having the meal delivered and instead either picking it up on the way home from work or making the short trip to the restaurant yourself to get it.

36

Fad Diets

Special pills, powders, or meal plans that promise to help you lose weight or transform your health are not only baloney 99 percent of the time, they are also often a hugely expensive weekly drain on your bank account. You should know by now, either by personal experience or by seeing others go through a few yo-yo diets themselves, that such fads are a waste of time and money.

There is no way you need more than 100 channels, so why are you paying for all of them? Instead of blowing $40 or more a month on a huge list of channels you rarely actually watch, you should have smartened up to the fact that you can get a better deal by paying for a streaming service like Netflix or Hulu and maybe a limited package for live sports if that's a must-have.

38

Roaming Charges

If you're a frequent traveler, you should have learned by now how to avoid getting hit with any international roaming charges on your phone, either by ensuring roaming is off before you set foot in a foreign country, or getting a phone plan that ensures such usage won't cost you.

39

Bank Fees

If you noticed mysterious fees on your latest bank statement, for "service charges" or something similarly vague and that you don't believe you are actually even using, you should know by now that you can call your bank and in almost every case, they will be removed. But if you don't ask, or don't take the time to review your account transactions, you'll continue losing money in this unnecessary way.

40

Name-Brand Medication

While generic medications may not have the expensive advertising campaigns name-brands do, that doesn't mean they're any less good. Generics contain the same active ingredient as their name-brand counterparts, as well as some of the same inactive ones, so unless you have a specific allergy to the formulation of a generic prescription, you should be able to safely use them if your doctor signs off on it.

41

Exercise Equipment

While you may be wisely saving money by cutting out your gym membership by setting up a home gym in your basement, you might sacrifice all these savings by blowing your money on fancy, brand-new exercise equipment that you use a few times and then ignore. A basic exercise bike or bench press will give you all you really need, and can usually be found for a low price on Craigslist. And if you're really looking to make an amazing workout space in your house, start with these 27 Affordable Ways to Turn Your Home into a Luxury Gym.

42

Movie Theater Snacks

A great place to blow $20 on something that would cost $5 anywhere else is the movie theater concession stand. Mediocre popcorn and a giant fountain drink might add a certain something extra to your movie-watching enjoyment, but hardly justify the expense. You should know that you're better off bringing a small snack of your own to the theater and keeping that $20 in your wallet.

43

Bread Machines and Pasta Makers

These are a serious cash sink—as are other similarly pricey and rarely used kitchen appliances. While you might think you'll get a lot out of a juicer or deep fryer, chances are that you'll use these sorts of machines a couple times before moving them onto the back of a shelf and promptly forgetting about them.

44

Organic Junk Food

If you think those cheese puffs you bought at Whole Foods are any better for you than the ones you got at your local bodega, you're kidding yourself. While they may be full of organic, non-GMO ingredients, at the end of the day, all they're doing is adding empty calories to your daily total—much like their cheaper counterparts.

45

Expensive Baby Clothes

When you hear that a friend, family member, or co-worker is having a baby, a person's first impulse is often to head to their nearest baby store and buy a show-stopping outfit. And while the thought is undeniably well-intentioned, make no mistake: even the most adorable babies routinely expel bodily fluids on their pricey outfits, meaning those designer clothes you bought them end up being little more than an expensive burp rag.

46

In-App Purchases

Tempting though it may be to buy that upgraded outfit for your character or advance to a new, purchase-only level in your favorite game, doing so is a serious waste of money. While the cost may seem small initially, a single in-app purchase of $3.99 a day for a year will run you $1,456.35 if you keep the habit up on the daily.

47

Couponing Purchases

As counterintuitive as it may seem, couponing may cost you big in the long run. While the folks who treat couponing like a full-time job may be able to score some impressive hauls for little to no money, for many people, it means buying huge amounts of things they don't really need—a hundred bottles of furniture polish here, 40 boxes of brownie mix there—just to score a discount. The end result? A fire sale on that profusion of products when it starts to encroach on the space once designated for the things you actually need to get by.

48

Unreturned Items

It happens to everyone: you order something online, it doesn't fit or isn't quite the way you'd pictured it, and you shove it in a closet, assuring yourself you'll be sending it back soon. Instead, it languishes there, gathering dust, until it becomes the latest piece of unwanted ephemera tossed into the pile at the office White Elephant.

49

Heating and Cooling Costs

Heating and cooling costs tend to be two of the largest monthly bills in a person's life, and, unlike a mortgage or a car payment, they never go away. Unfortunately, it's likely your own preferences are intertwined with those ever-rising bills: habits like leaving the air conditioning on when you go out, setting it to the coldest temperature possible, or cranking up the heat instead of putting on a sweater all lead to your high heating and cooling costs. The good news? A smart thermostat can help save you serious cash in the long run, as well as reducing your carbon footprint.

50

Fast Fashion

It's called fast fashion for a reason: those cheap items you pick up at certain retailers in your local mall aren't exactly meant to be passed down as heirlooms. While fast fashion stores may have some inexpensive, but quality basics to supplement your wardrobe with, like t-shirts and accessories, if you're looking to them for wardrobe staples, you'll end up spending more money in the long run when those items inevitably wear out.